Modernize your retail clients’ investing experience

Improve client engagement.

Replace legacy systems with cutting-edge API technology that keeps pace with digital disruptors. Our platform is specifically designed to help incumbents migrate assets smoothly, expand and diversify revenue streams, and reduce operational expenses.

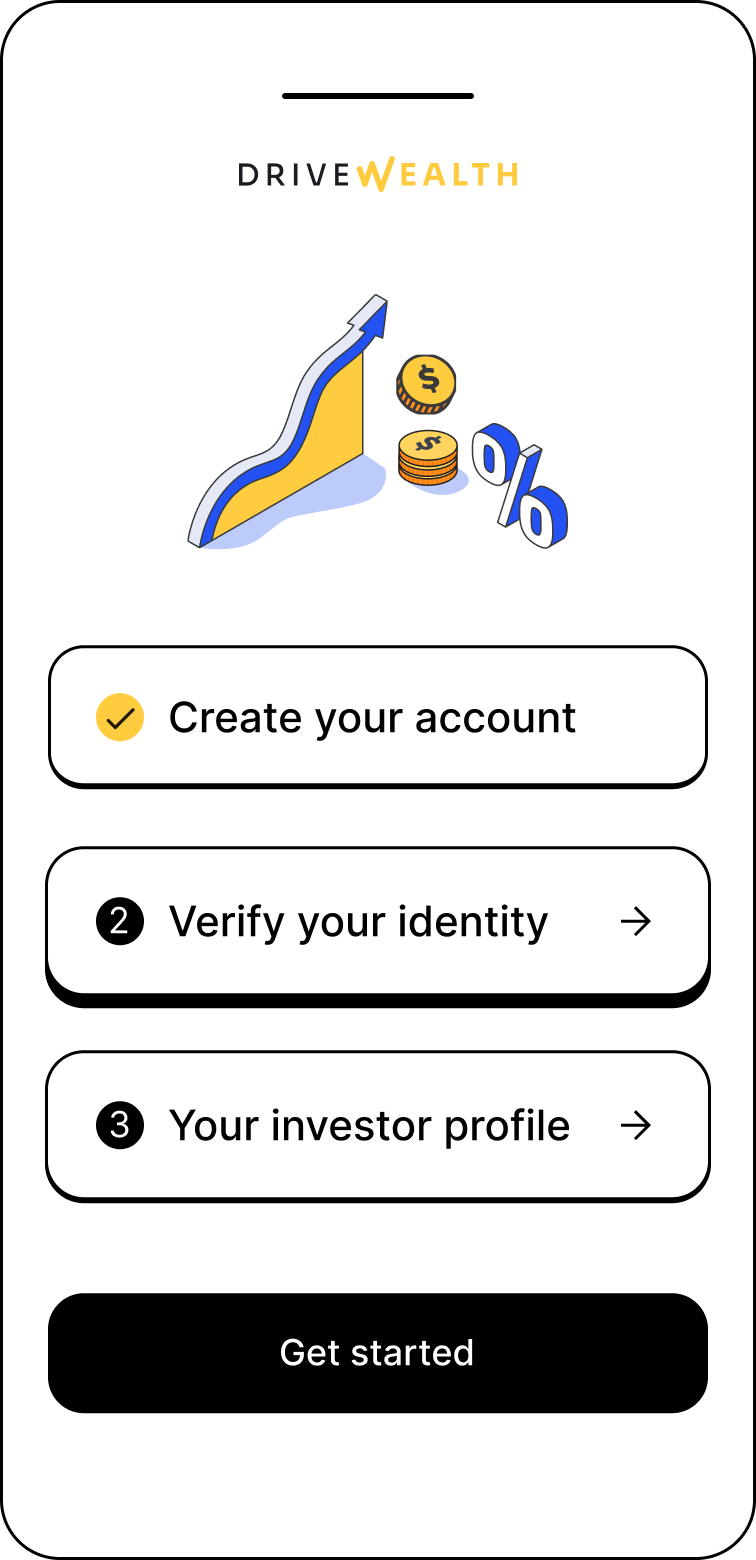

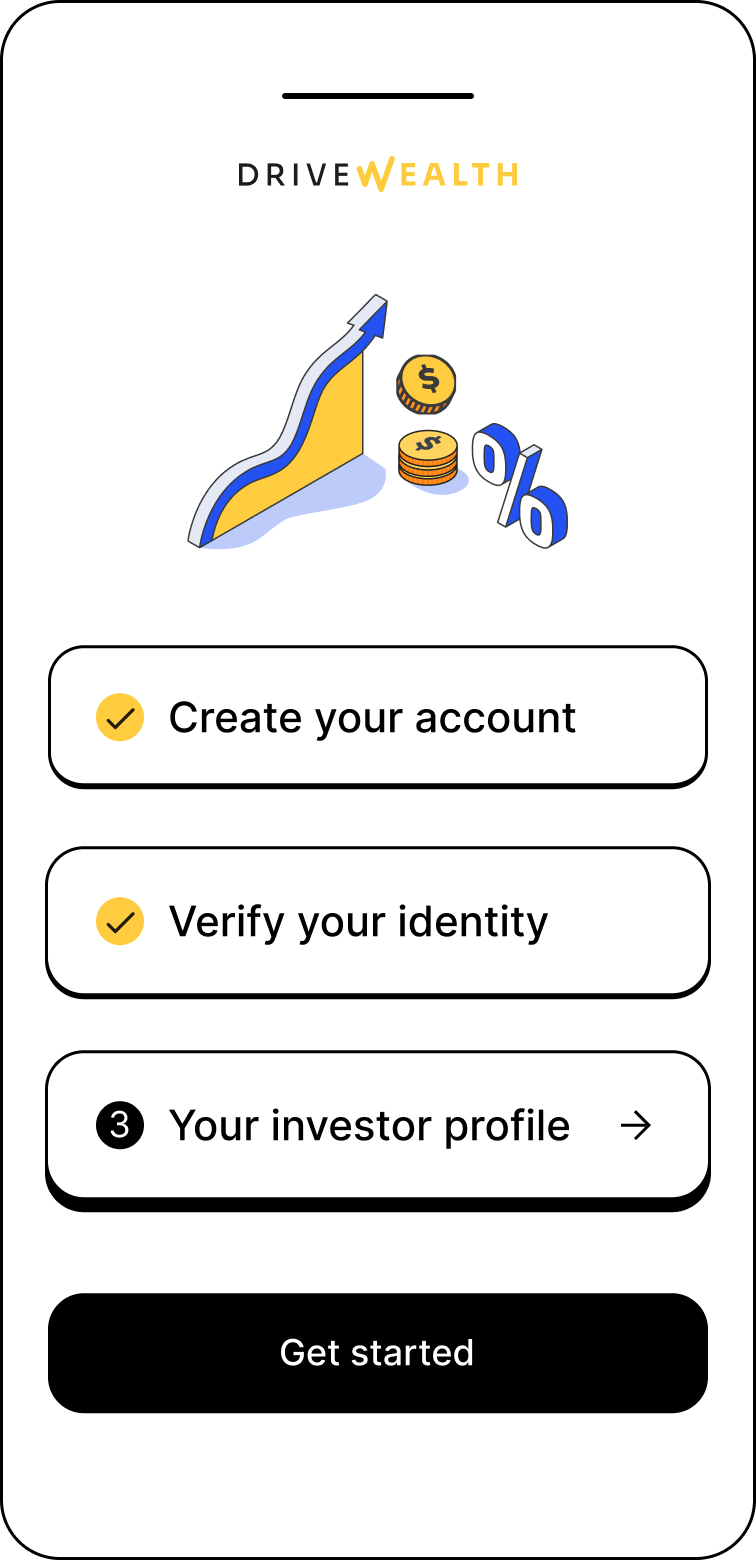

From client onboarding to client reporting

Onboarding

- Know Your Client (KYC)

- Anti-Money Laundering (AML)

- Client Identification Program (CIP) verification

- Digital account opening

The KYC process includes identification verification to help assess and monitor risks associated with money laundering, financing terrorism, and other illegal activities.1

- Confirm the source(s) of customer funds

- Verify each client’s identity digitally or manually

- If a Partner conducts its own CIP for KYC/AML, we may be able to establish a reliance agreement between the regulated entities

- DriveWealth must perform CIP for any non-US registered Partners. Customers outside the US can digitally upload images of their ID or proof-of-address documents to satisfy KYC and AML requirements

1 For US Partners DriveWealth conducts counterparty due diligence to make sure that reliance is reasonable under the circumstances. For Non-US Partners DriveWealth cannot rely on the onboarding efforts of foreign counterparties – effectively AML is conducted twice, once by each counterparty.

Account Management

- Digital identity verification and KYC

- “Cashless” instant funding mechanisms

- Automated account transfer capabilities (ACAT)

- Range of available account types

We can create a client account instantaneously so Partners’ clients can begin trading in seconds by:

- utilizing a series of digital vendors who enable us to verify clients in real time, or we can rely on our Partners’ data

- creating a digital “cashless” wallet that can be used as a single source of funds for purchasing and investing

- easily facilitating transfers from an existing brokerage account to a DriveWealth account

- making the following account types available– self-directed, advisory, managed accounts, and traditional retirement accounts

Asset Servicing

- Positions and cash reporting

- Corporate actions

- Reconciliations

- API event notifications

The DriveWealth Dashboard provides real-time management of middle- and back-office functions, allowing Partners to easily manage all phases of their business.

Manage client accounts pre- and post-launch

- Edit client profile details

- Create manual orders

- Perform order ticket audits

- Download official statements

Manage your back office

- Validate API usage

- Assign employee user roles and permissions:

- Choose from pre-set roles based on Series 7 and 24 licensing

- Customize permissions as needed to ensure compliance with security regulations

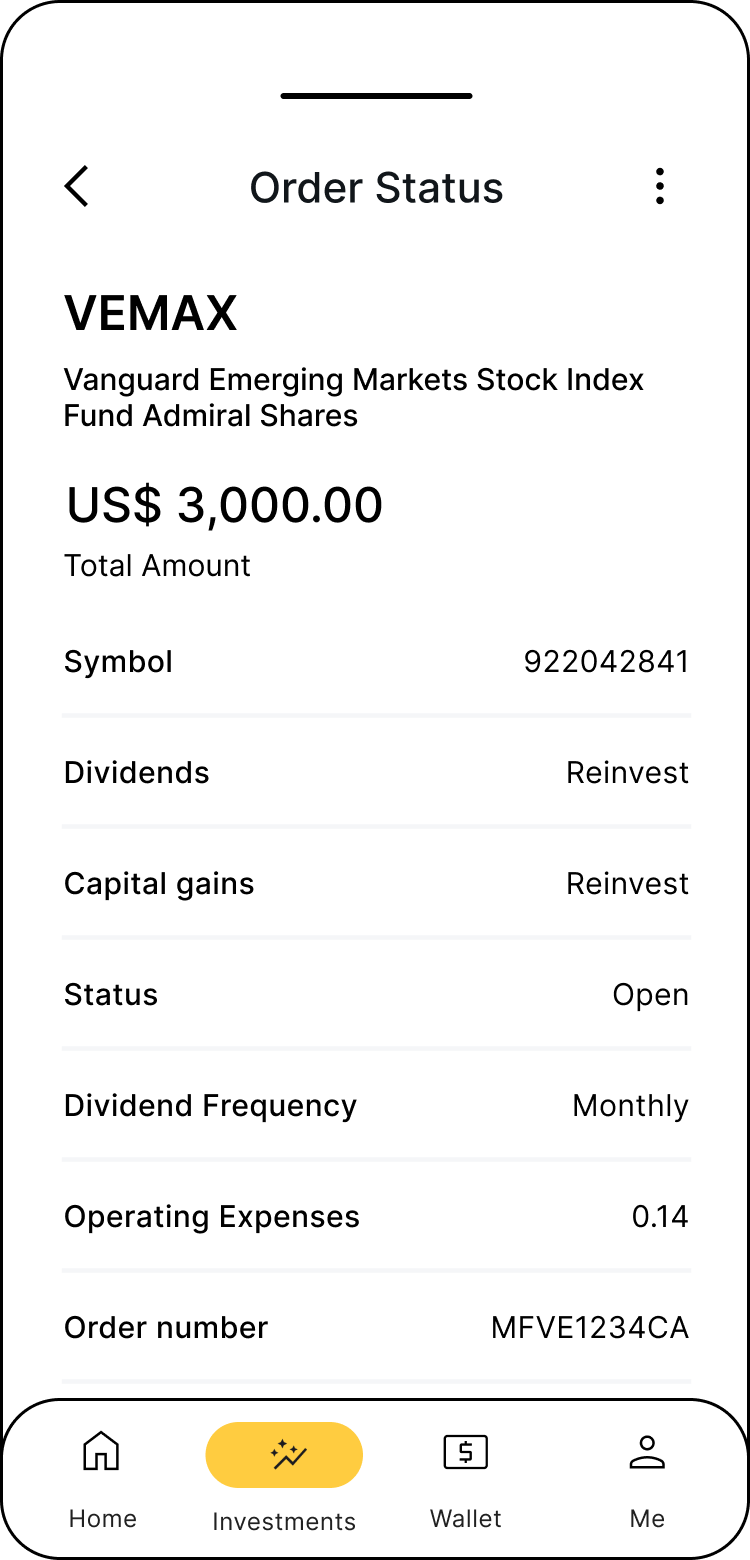

Investing

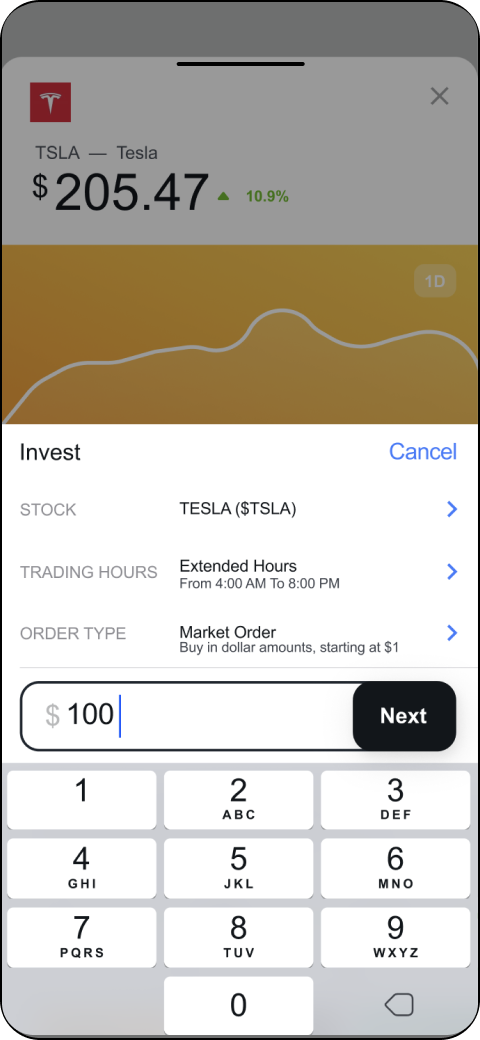

- Fractional share execution through patented Fracker® technology

- Access to equities, ETFs, mutual funds, fixed income, and options

- 24-hour x 5 day equity trading

- Fundamental data and charting

- Dividend reinvestment

DriveWealth pioneered fractional share trading in 2015. Our patented* Fracker® technology gives Partners the freedom to offer fractional equity investing experiences that bring the markets to new participants for pennies a trade.

Together, we can enable Partners’ clients to:

- Buy as little as $1 of a company’s shares

- Create a diversified portfolio for less than a share of stock

- Access our exclusive fractional share universe of 9,600 securities and counting

- Buy and sell fractional shares with real-time execution out to eight decimal places

*Patented in the US, Korea, Japan, and China, with more pending.

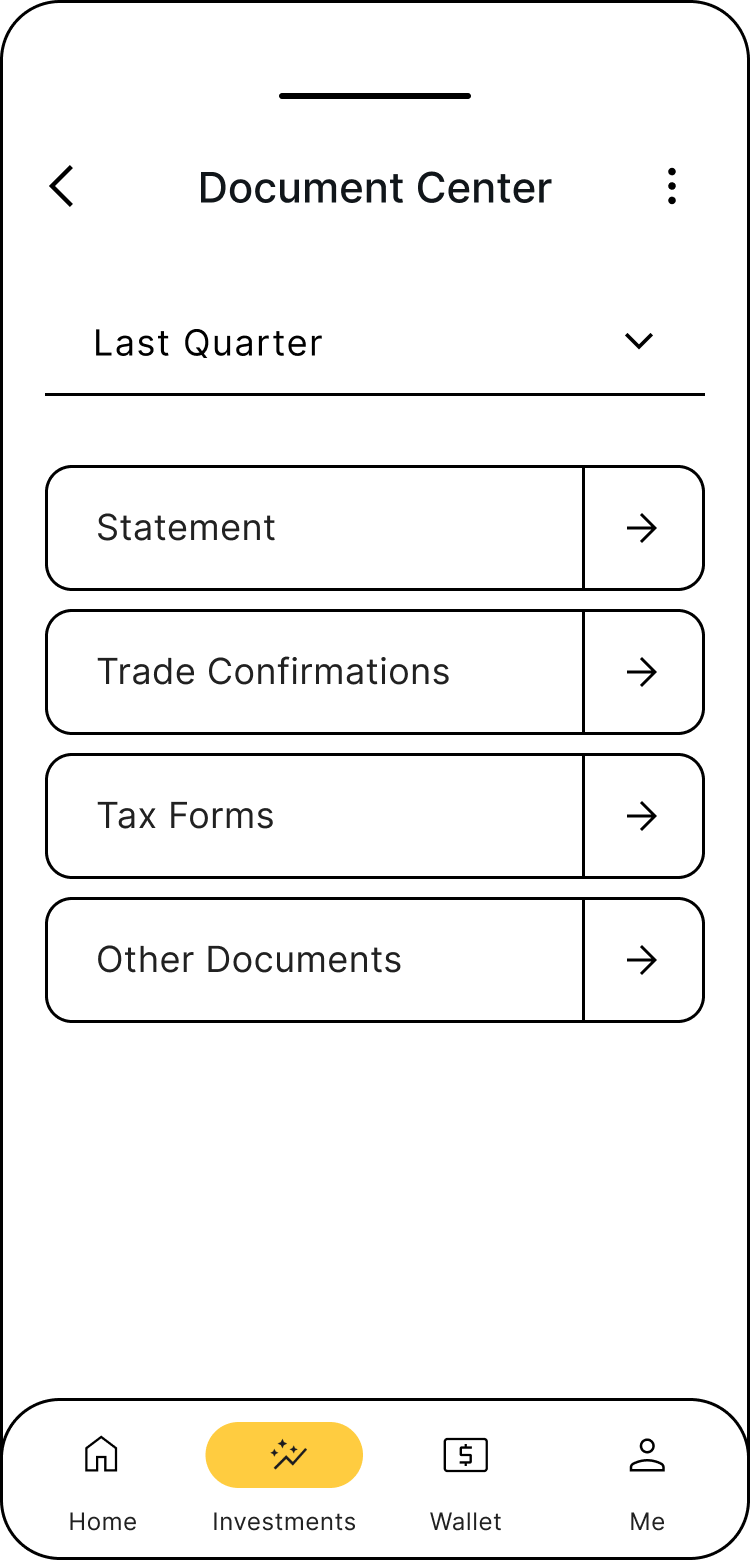

Reporting

- Statements

- Trade confirms

- Tax reporting

- Proxy voting

- Prospectus delivery

- Regulatory and compliance requirements

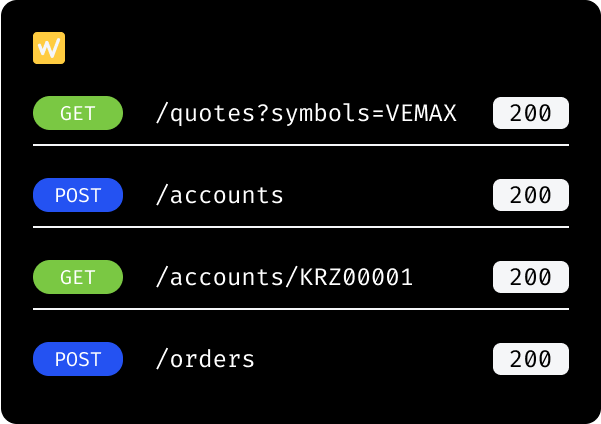

Our APIs make it easy to deliver client reporting:

- The account summary API provides financial details such as positions, orders, past transactions, in addition to P&L and open quantities

- The performance API returns (un)realized gains/losses in real time, plus historical summaries on a daily basis

We offer an events API that sends updates when the state of another API resource changes to avoid the inefficiency of constantly polling an API for updates.

Account statements, trade confirmations, and tax documents

- Access to documents is provided through a simple API call

- The response details provide a time-sensitive PDF link that can be sent to the end user account statements and trade confirmations will be branded with Partner logos

Support

- Customized integration plan

- Strategic planning and delivery

- Quarterly reviews

- Roadmaps for product releases

- Co-development and innovative collaboration

App Design

Our Solutions Engineers play an important role in tailoring our platform to address specific Partner needs.

Seamless Integration

We create customized integration project plans that offer dedicated support to our Partners’ technical and business teams.

Post-launch Support Resources

Partners are assigned a dedicated Relationship Manager to guide all post-launch initiatives including the integration of any new solutions.

Ready to get started?

Connect with us and let’s discuss how to empower your clients with modern, innovative products and solutions.

Who we are

Learn more about how DriveWealth provides modern, innovative products and solutions.

Partner services

Take control of your business using our Partner dashboard to manage many of the “back office” investing functions.

Developer portal

Check out our comprehensive guides to build your platform.